Income & Expense Tracker – Monthly BAS & Fuel Tax Credits 2025/2026

Income & Expense Tracker – Monthly BAS & Fuel Tax Credits 2025/2026

Couldn't load pickup availability

GST registered and lodge monthly BAS? 🚀

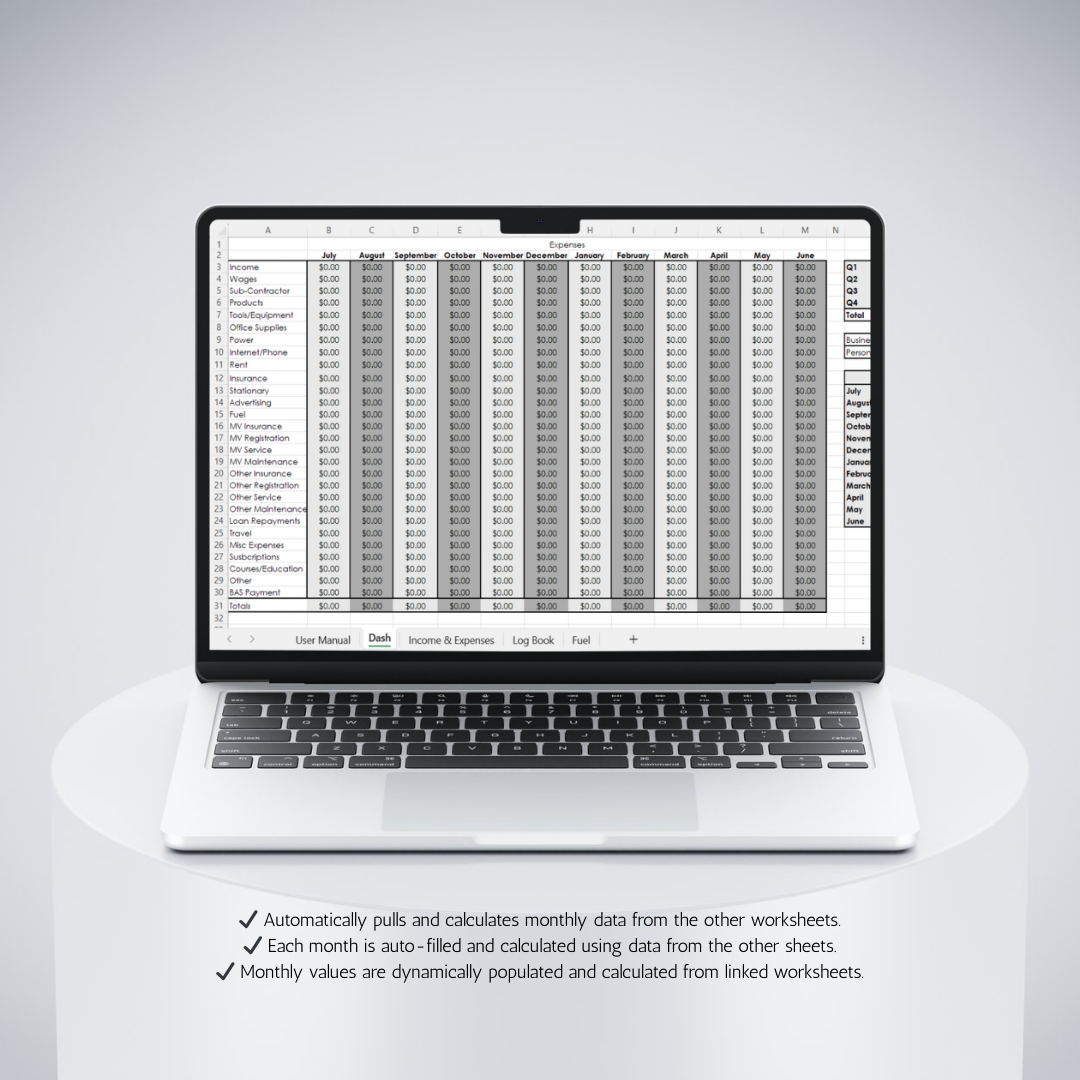

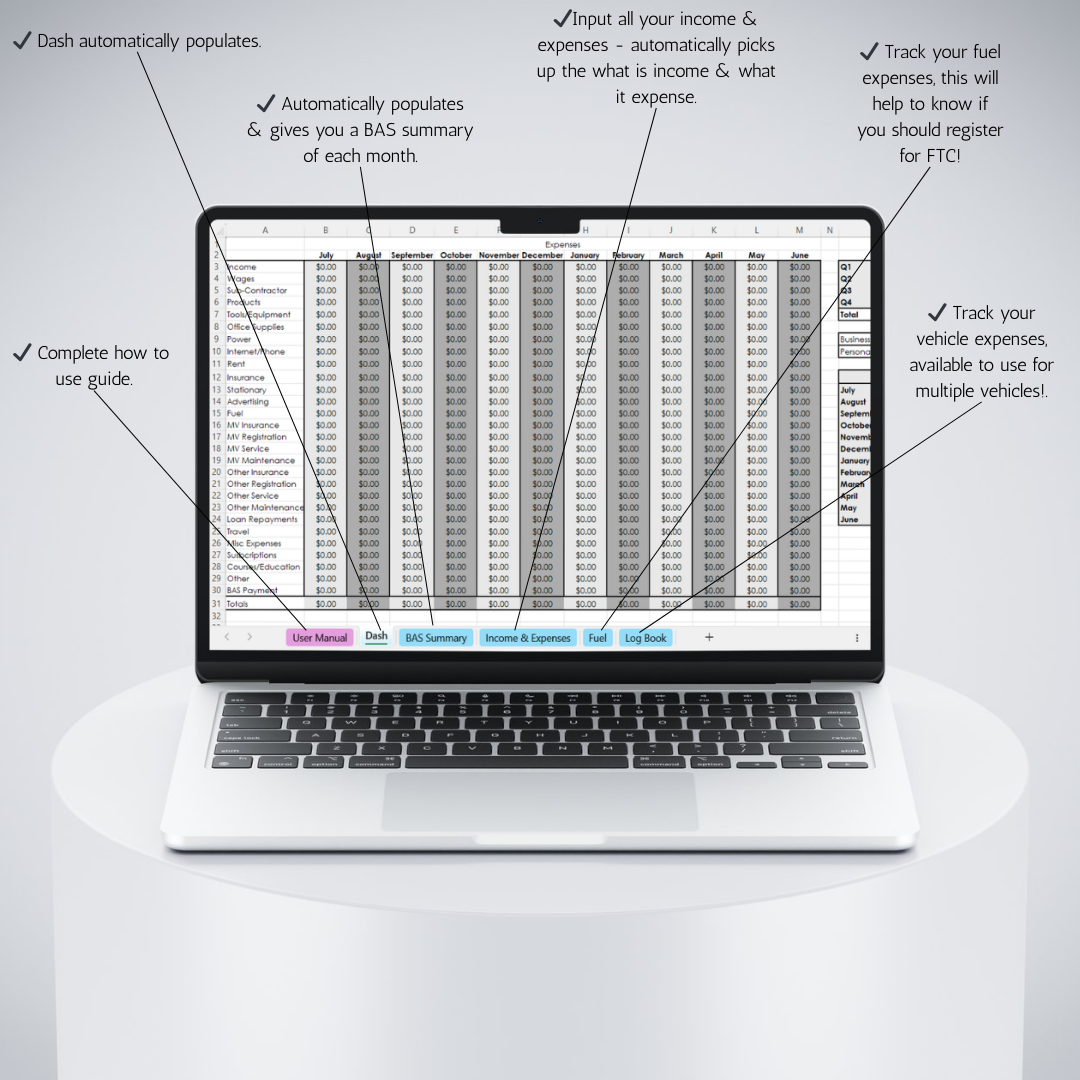

This Monthly Income & Expense Tracker with BAS & FTC support is designed to make your monthly reporting a breeze. Track every dollar of income, categorise your expenses, and auto-calculate your GST obligations and Fuel Tax Credits.

✔️ Made for GST-registered businesses

✔️ Fuel Tax Credit logging included

✔️ Monthly BAS-ready summaries

✔️ Categorised tracking + user-friendly layout

✔️ Automated net profit & GST summaries

Stay organised, stress less, and be BAS-ready all year long — no fancy accounting software needed! 📈🧾

Collapsible content

✅ 1. Designed Specifically for GST-Registered Businesses

Created with Australian GST rules in mind, this tracker helps you accurately log income and expenses, calculate GST collected and paid, and keep your monthly BAS prep simple and stress-free.

✅ 2. Fuel Tax Credit Tracking Built-In

No more guesswork — easily log eligible fuel purchases and calculate your monthly FTC with auto-formulas built to save you time and keep you compliant.

✅ 3. Automated Monthly BAS Summaries

Get a clear, ready-to-use summary of your monthly BAS figures, including GST on income, GST on expenses, FTC totals, and your net amount payable or refundable.

✅ 4. Smart Layout for Categorised Tracking

Track and sort your income and expenses into business-friendly categories. Everything is laid out in a clean, user-friendly format that’s easy to update and interpret at a glance.