Income & Expense Tracker – Quarterly BAS & Fuel Tax Credits 2025/2026

Income & Expense Tracker – Quarterly BAS & Fuel Tax Credits 2025/2026

Couldn't load pickup availability

Quarterly BAS prep just got easier! 💪

This smart, streamlined Excel tracker is perfect for GST-registered businesses that lodge quarterly BAS and claim Fuel Tax Credits. Stay ahead of your finances with categorised tracking, automated summaries, and quarterly BAS-ready reports.

✔️ Designed for quarterly BAS lodgers

✔️ Fuel Tax Credit calculation included

✔️ Auto-calculated quarterly summaries

✔️ Categorised income & expense tracking

✔️ User-friendly and tax-time ready

Take the guesswork out of quarterly reporting and focus on growing your business — not fighting spreadsheets. 🧮📅

Collapsible content

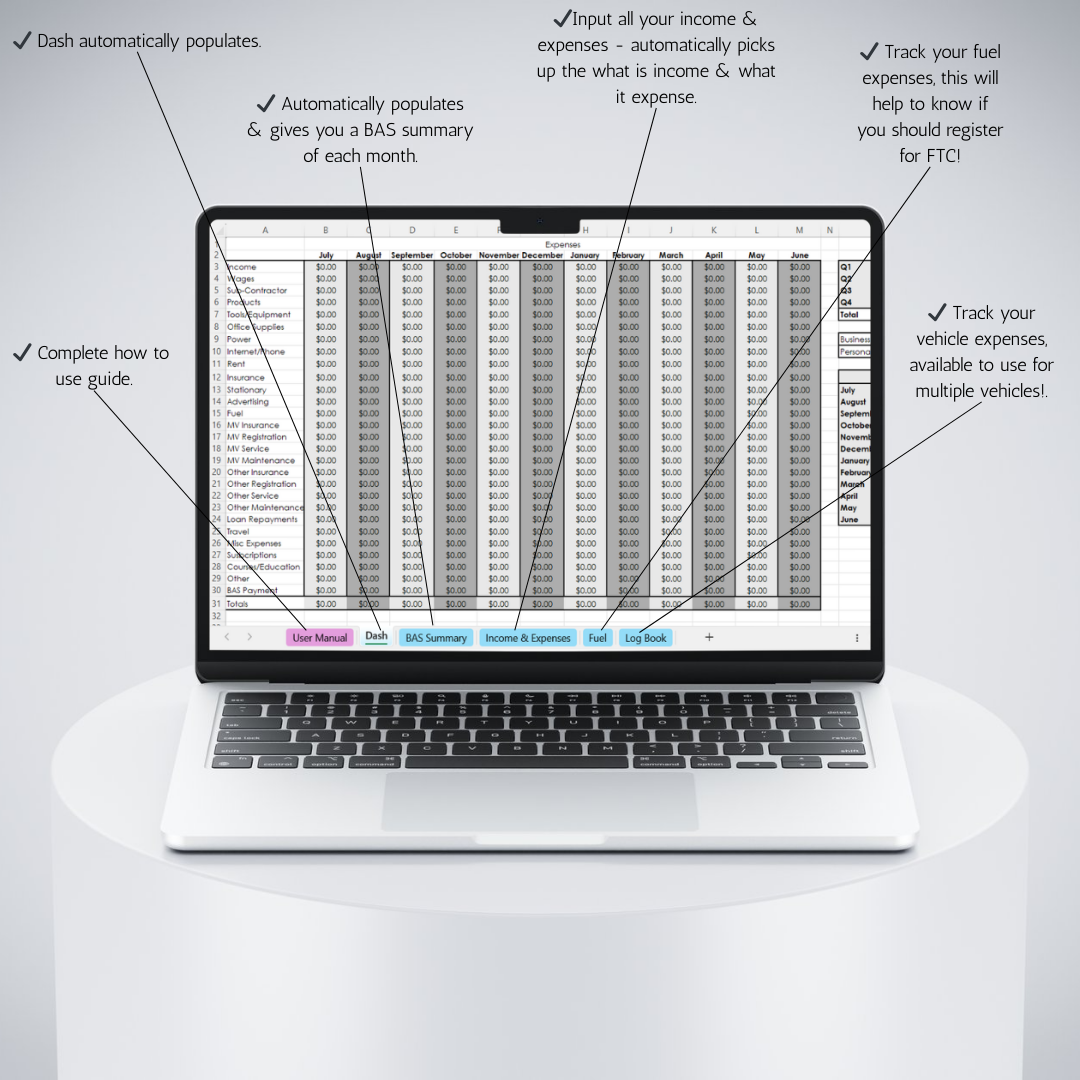

✅ 1. BAS-Ready for Quarterly Lodgers

This tracker is built specifically for GST-registered businesses that lodge quarterly BAS. Capture income, expenses, and GST with ease — and generate clear summaries ready for BAS submission every quarter.

✅ 2. Fuel Tax Credit Support Included

Accurately track your fuel purchases and calculate your FTC (Fuel Tax Credits) automatically. Save time and reduce errors with a built-in system designed for Australian businesses.

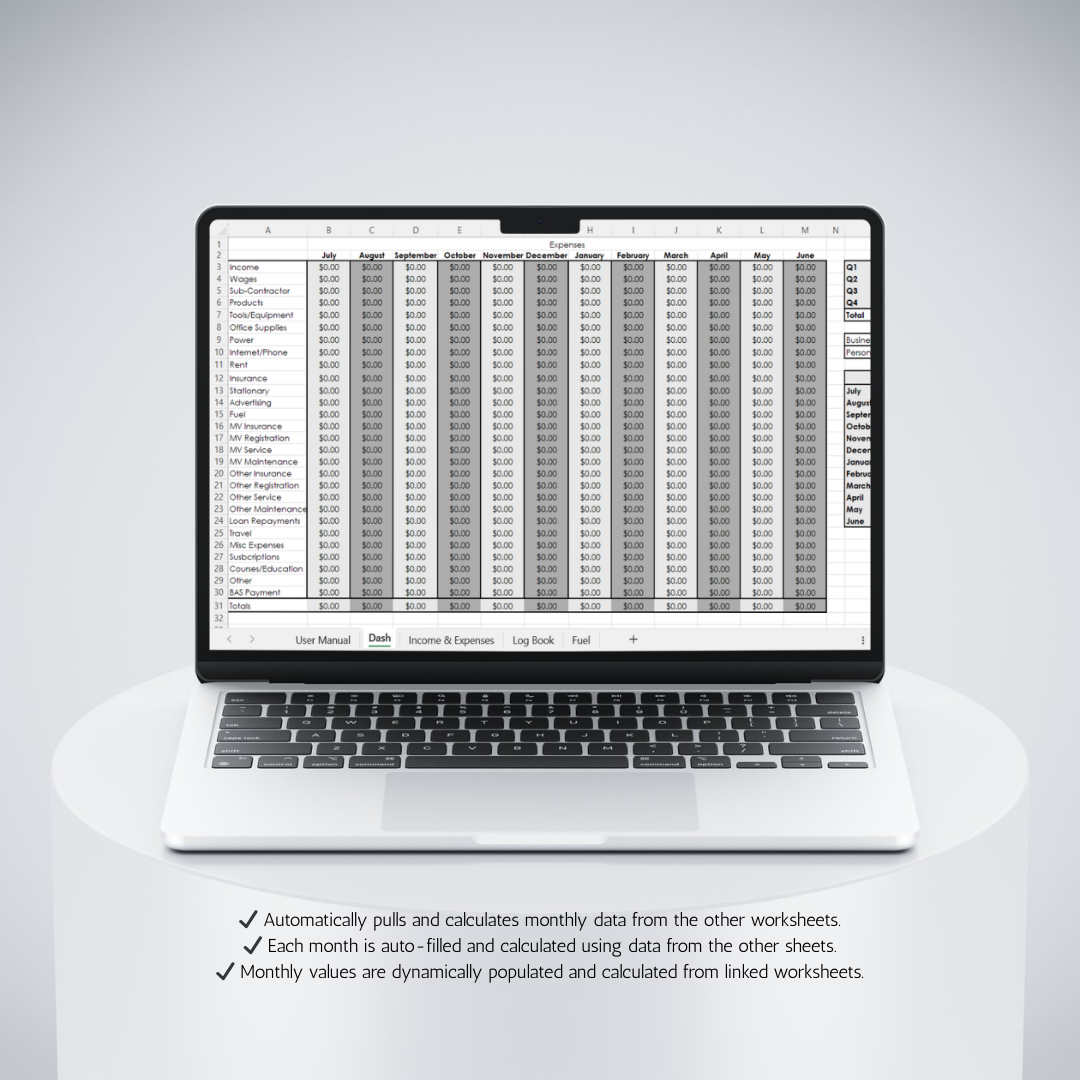

✅ 3. Easy Quarterly Summaries with Auto-Calculations

No more last-minute spreadsheets! Your totals for GST collected, GST paid, FTC, and net GST payable/refundable are automatically calculated and clearly displayed at the end of each quarter.

✅ 4. Clear, Categorised Tracking All Year Long

Each expense and income entry is categorised for easy review and reporting, helping you stay on top of your numbers and prepare confidently for tax time.